A common theme over the last decade from the Saskatchewan government has been the adoption of Alberta regulations, or something that is a very close approximation, in the oil and gas industry. We’ve seen this in the business process implementation, venting and flaring regulations, burner regulations and other areas.

One of the often-cited reasons for this is that most of the larger oil companies that work in Saskatchewan also work in Alberta, and it makes it easier for them to have one type of regulations to work under. A second point is there’s no reason to re-invent the wheel, or regulations, as it were. If it works in Alberta, it’s a lot easier to cut-and-paste their regs than cook up something entirely different here.

As such, Saskatchewan’s regulatory regime has grown much closer to Alberta’s. We should point out that Alberta’s regulatory regime is also much-criticized for being slow and cumbersome. That’s one of the reasons we’ve heard from many oil company executives over the years that they prefer to work in Saskatchewan as a result.

The problem lays in the geology. Our rocks simply are not as good as Alberta’s. So if all things are going to be equal on the regulatory and cost of doing business side, Saskatchewan will lose every time because of their better geology.

Perhaps some of this came to pass on April 11, when the Saskatchewan Ministry of Energy and Resources announced bi-monthly Crown Land Sales. It came it at a measly $1.5 million. In the nearly 11 years Pipeline News has been published in this form, it was one of the worst land sales. Pathetic and abysmal would both be appropriate descriptors. There may be several reasons for this – including the fact Crescent Point Energy Corp. is selling nearly all their production east of Highway 47, but competitiveness is likely one of them.

No matter how bleak these things may be, ministries are expected to put a positive spin on it. So the accompanying press release noted, “On both a fiscal and calendar year basis, Saskatchewan continues to post the highest average-per-hectare revenues among the western provinces, ‘A clear indicator of Saskatchewan’s continuing competitiveness and status as a jurisdiction of choice for the industry,’ the release said.

“‘Industry sources frequently identify Saskatchewan as having a very attractive operating environment and fiscal regime,’ Energy and Resources Minister Bronwyn Eyre said. ‘We are also home to some of the best and most cost-effective conventional oil and gas development opportunities you will find anywhere. It’s not surprising that when we talk to audiences around the world about the investment opportunities in Saskatchewan, we are often talking about oil and gas.’”

Jon Hromek, president and CEO of Adonai Resources II emailed us a contrary opinion, and an hour-long discussion on April 16 laid out many of his concerns. We also spoke to two other small junior producer CEOs on that day, and they all sung from the same choirbook.

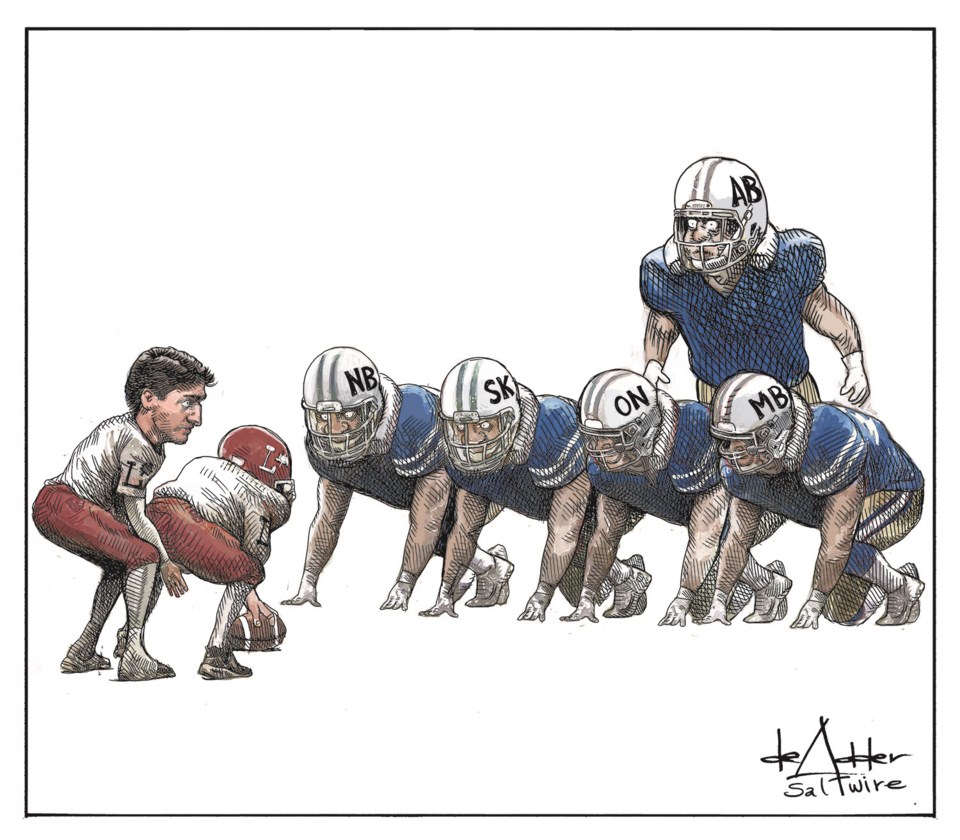

That date was poignant, as that night Jason Kenney swept to power as the new Alberta premier. His acceptance speech mentioned a drive to cut red tape and reduce business taxes to make that province more competitive.

In the collective opinion of the Saskatchewan CEOs, this province is not all that competitive anymore. They all feel that the Saskatchewan oil industry is, for a lack of a better term, being henpecked to death.

Indeed, asking one of them if this was “death by 1,000 cuts,” he agreed. The name of a Feb. 1, 2018, report by Benjamin Dachis of the C.D. How Institute just happened to be entitled, “Death by a Thousand Cuts? Western Canada’s Oil and Natural Gas Policy Competitiveness Scorecard.”

This is not a coincidence.

If you have a choice of investing in Alberta, where there is much better geology, or Saskatchewan, where the geological risk is far higher, the CEOs say Saskatchewan needs to be competitive in other areas to make up for that geological risk. Since our regulatory regime is now more and more like Alberta, we lose.

The suggestion isn’t that we shouldn’t be as stringent or as good of stewards, but it should be about different regs applicable to different situations.

One CEO noted that through various mechanisms, 50,000 to 60,000 barrels of oil equivalent worth of production is up for sale in Saskatchewan in one way or another, including public offerings. The six parcels that Crescent Point has up for sale have been shopped around for a long time now. While we’ve heard some deals may soon be in place, we’ve not heard any announcements yet. The length of time this is taking is definitely a reflection on the interest, or lack thereof, in Saskatchewan.

It’s not just Alberta that we need to be concerned about. These days, that’s minor. It’s Texas, and to a lesser extent, North Dakota, which are sucking all the oxygen out of the room, leaving Canada gasping. Remember, they don’t have US$100 oil, either. Yet in the past decade Texas, alone, has added almost as much production as all of Canada currently makes. North Dakota in the last year has added 200,000 bpd of oil production. That’s about 41 per cent of Saskatchewan’s total production – and they added it in a single year.

The Trump administration is taking a substantial growth trend accomplished under the Obama regime and pouring steroids into it. This is who we are competing with now.

Instead of just repeating worn out mantras of about competitiveness, perhaps the Saskatchewan government needs to take a good look at this, before we are left behind.