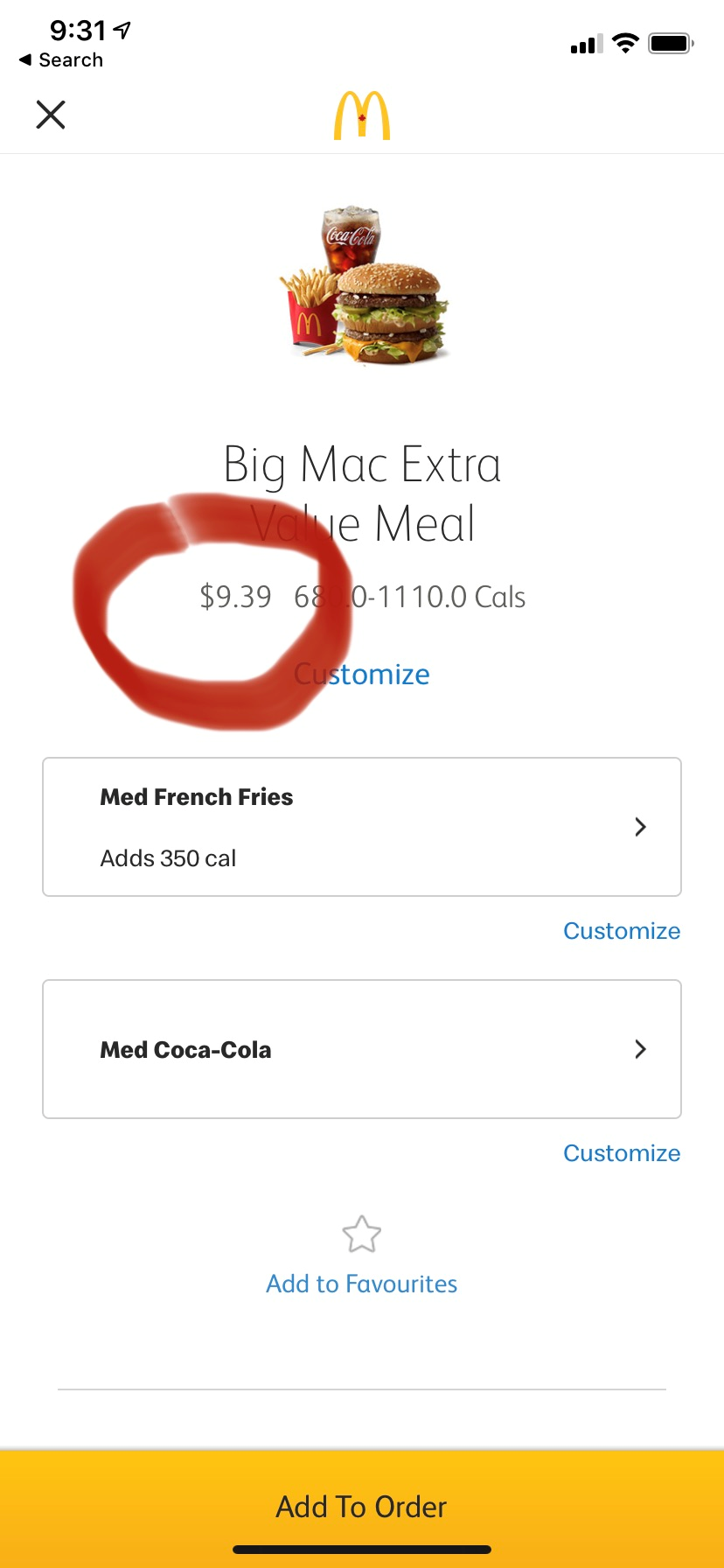

The evening of Friday, March 27, I was hungry. Damned hungry. I’m not going to many restaurants these days, for obvious reasons, but I looked up on my phone’s app to how much it would cost me to buy a Big Mac. The answer was $5.89, plus tax. A meal with regular fries and Coke is $9.39.

If I sold a barrel of Western Canadian Select (WCS) crude oil, the benchmark set at the hub of Hardisty, Alta., I buy a Big Mac, and pay the tax, but I could not the fries and Coke.

And that’s not even supersized, either.

BNN Bloomberg reported WCS crude oil closed at an abysmal US$5.06 that day, down 21.6 per cent from the horrific day before.

If you took the dollar conversion on the same day, your US$5.06 gives you C$7.10. Like I said, enough for the Big Mac, but not the fries or Coke.

I might be better off buying a McDouble meal, which comes in at C$5.00 for the meal. Then maybe I could maybe buy two apple pies, to slake my hunger?

No sir! After tax, a McDouble meal with two apple pies comes to $7.54, which is 44 cents more than the value of a barrel of Western Canadian Select.

Now, what could I make from a singular barrel of WCS? Since heavy crudes accounts for roughly two-thirds of Canadian oil production, and the Canadian Association of Petroleum Producers uses these number for an “average barrel of Canadian oil,” then the numbers shouldn’t be two far off. Note that a barrel of oil is 158.987 litres.

So our one barrel of WCS crude oil gives me 56.6 litres of gasoline, 41.2 litres of diesel, 22.3 litres of all other products, including petrochemical feedstocks, 11.4 litres of light fuel oil, 10.8 litres of heavy fuel oil, 6.2 litres of aviation fuel, 6.2 litres of asphalt, and finally, 4.1 litres of propane/butane.

Wow, that’s pretty damned good for a barrel that won’t pay for Big Mac meal.

I understand it costs somewhere around US$7 to US$9 to ship a barrel of oil by pipeline from Hardisty to its refinery destinations. It could be a little different, but not much more.

In other words, is now costs significantly more to ship the oil, than it is to buy the oil itself.

I spoke to a car dealer on the same day. I pointed out to him that this is the equivalent of me walking into his dealership, paying the freight on a new half-ton, then paying him less than the freight for that very same pickup, and drive away with a brand new truck.

But thinking about it later, why would I limit myself to a half-ton? If I’m getting it for such a deal, why not get a loaded up one-ton with a four-inch lift and mudder tires. After all, I’m only paying the equivalent of the freight, right?

This, my friends is what we’ve been reduced to, here in Western Canada. Our until-now most valuable product we produce in Western Canada is now worthless, and we export nearly every drop we don’t use ourselves to the U.S., who, as far as I know, haven’t exactly stopped buying it yet. Yet, being key here.

I would love to know what the crack spreads are going to be on that (i.e. the profitability refiners make). Even though consumption is dropping through the floor right now, if I were a refinery, I would be buying and storing every barrel I could get my hands on. It’s essentially a free feedstock at this point. And as crude, it’s not going to go bad. It’s been in that state for millions of years. It’ll keep.

It might take a six months to a year for consumption to even start looking a bit like normal, but who cares? If you, the oil trader, put away a million barrels at US$5.06, and WCS eventually gets back to US$35, how munch money are you going to make on that? Do the math for yourself.

President Donald Trump is apparently following a similar strategy, announcing on March 13 he would be topping up the U.S. Strategic Petroleum Reserve for next to nothing, buying 30 million barrels of American crude.

“We’re going to fill it right up to the top, saving the American taxpayer billions and billions of dollars, helping our oil industry [and furthering] that wonderful goal — which we’ve achieved, which nobody thought was possible — of energy independence,” CNBC reported.

If I were him, I’d get serious about building additional tanks and storage caverns.

Trump was going to buy that oil, until Congress stopped him on March 26. Silly Congress. They apparently didn’t know the deal of the lifetime. I guess that’s what happens when you have a billionaire president and a Congress full of politicians.

This doesn’t do any favours for Canada, however. We have no strategic petroleum reserve. Instead, we’re going to soon start shutting in wells all over the place, until things improve.

On March 26 the executive director of the International Energy Agency, Fatih Birol, said oil demand could fall 20 million barrels per day.

The different between US$30 oil and US$100 per barrel is 2 million barrels per day of production. We’re looking at 10 times that.

Oil prices are not going to recover any time soon.

It’s going to be brutal, so brutal you won’t even be able to get fries with that.

Brian Zinchuk is editor of Pipeline News. He can be reached at brian.zinchuk@sasktel.net.

.