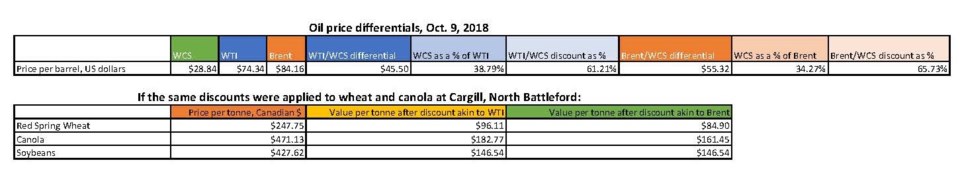

On Oct. 9, the price differential between West Texas Intermediate (WTI) and Western Canadian Select (WCS) hit US$45.50 per barrel, according to sister publication Daily Oil Bulletin. One barrel of WTI was trading for US$74.34 per barrel while a barrel of WCS traded for an implied value of US$28.84 for the November 2018 price.

That means that WCS was selling for just 38.9 per cent of WTI, or a 61.2 per cent discount.

The differential is even more stark when Western Canadian Select is compared to Brent, the global benchmark for oil. With Brent coming in at US$84.16, WCS was trading at a US$55.32 differential per barrel, or a 65.7 per cent discount to the world price.

If those same discounts were applied to various agricultural commodities at Cargill, North Battleford, which is adjacent to heavy oil country, red spring wheat would fetch $96.11 per tonne instead of $247.75, when compared to the WTI discount. The Brent discount, applied to the same wheat, would result in a price of $84.90 per tonne.

Instead of getting $471.13 per tonne for canola, the discount, akin to WTI/WCS, would see a price of $182.77 per tonne. The Brent discount would see only $161.45 per tonne of canola.

When it comes to soybeans, a WTI-level of discount would see a price of $146.54 per tonne, instead of the going rate of $427.62 per tonne. A soybean price compared to the Brent discount would see a price of just $146.54 per tonne.