Regina – With a hard look at the map of exploration licences sold in the Oct. 3 land sale, and one could easily get the impression there’s a new play in the works in Saskatchewan.

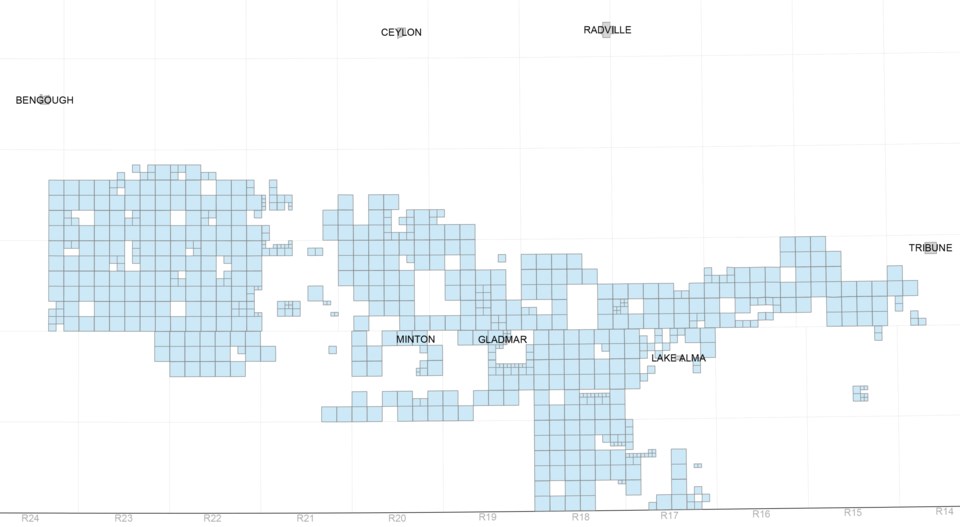

According to a map provided by the Ministry of Economy, the acquisitions extend primarily in Township 2, 3 and, at the western end, 4, from Range 14 to the eastern edge of Range 24. That correlates in an almost contiguous region along Township 3 from just south of Tribune to a line running south of Bengough, close to Highway 34. There is a noticeable gap along Range 21.

From Lake Alma to Minton, it extends southward into Township 2. Between Lake Alma and Gladmar, nearly the entire Township 1, Range 18, West of the 2nd meridian (1-18-W2) is included, right to the U.S. border. To the east, a portion of 1-17-W2 is also included.

While there has long been oil production in this region, it hasn’t been a happening place for a very long time.

Royce Reavley, professional geologist and manager of Crown sales, Lands and Mineral Tenure, Ministry of the Economy, provided some context for Pipeline News by phone on Oct. 19.

Asked if it was a new play in the works, Reavley said, he couldn’t support or deny that it is.

The October land sale did pick up on the heals of the August land sale, which saw six exploration licences in the same general area sell for a total of $1.6 million. That sale saw 17,612 hectares sell, nearly two townships.

The ministry press release noted, “These parcels are prospective for multiple targets including the Ratcliffe Beds of the Madison Group and the Bakken, Torquay, Birdbear, Winnipegosis and Red River Formations.”

As for what the targets might be, he noted, “There actually is potential for all those zones. There’s producing wells for all those formations in this immediate area.”

In most, but not all cases, the licences extend from the surface to the PreCambrian boundary – essentially the entire sedimentary column. That means the prospective oil companies could be looking at anything and everything.

The gap along Range 21 has existing Minton, Red River, Winnipegosis and Hardy South Red River pools, thus likely accounting for why they didn’t appear in the sale.

While 19 licences sold, one posted parcel did not sell due to no bids received. Asked if companies might be posting additional land, then not bidding on them as a way of bluffing their competition, Reavley said the ministry has a policy specifically meant to discourage “smoke parcels.” The ministry requires, in writing, a reason why companies posted a parcel, but chose not to bid on it.

Four land companies purchased 18 of the 19 licences. Due to confidentiality policies, the ministry cannot reveal much beyond that as to who is behind the bids.

A lease has a five-year primary term, allowing an oil company the right to explore, produce and sell oil and gas from the lease. They also secure a certain amount of land as wells are drilled, thus an oil company has up to five years to get drilling before their lease expires.

An exploratory licence, such has those in this sale, has a much shorter period. In this case, the oil company has only two years in its primary term to lock up land. The measured depth of wells drilled impacts the number of sections a company can secure to go to lease. The conversion factor for wells 1,800 metres or more is 50 per cent greater than that for wells less than that depth. As an example, Reavley said a 2,400 metre horizontal well, multiplied by the conversion factor and rounded to the nearest quarter of land, would result in securing 14.5 sections of land that the company could then lease. Doing so means the rental the oil company pays would go up for $1.75 per hectare for a licence to $3.50 per hectare for lease.

As for the volume of land involved in this sale, if not the dollar amount, it harkens back to large sales of the 2005 shallow Milk River gas play in west central Saskatchewan and the Viewfield Bakken play in 2007-2008, when Saskatchewan had its largest Crown land sale ever. With 112,567.9 hectares sold, roughly 12 townships of land are into play from this sale, plus another two townships from the last sale. For perspective, the area in question is roughly half the size of the Viewfield Bakken pool.

Reavley said it was probably the biggest sale since the downturn.