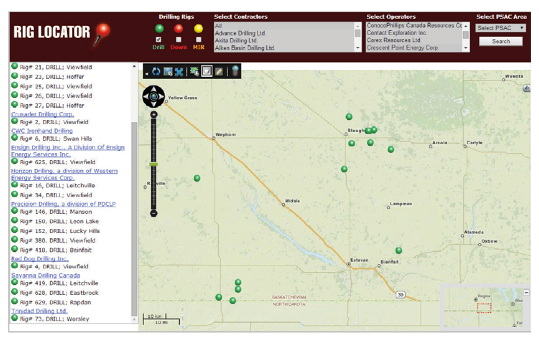

Estevan– Despite having sent out a letter to its vendors saying it expected price cuts, Crescent Point has done one thing many other companies have pulled back on – it has kept drilling.

As of Jan. 9, the company led all of Canada in its drilling activity, with 26 active drilling rigs. That’s even higher than what the company had last fall, when it led the nation with 25. The difference in early January is that there is a lot more distance between first and second place. Progress Energy had 19 rigs, while Canadian Natural Resources Ltd., Cenovus Energy and

Tourmaline Oil all had 17 each, according to Rig Locator (riglocator.ca), a sister publication of Pipeline News

.

Perhaps more importantly for this province, all but two of those 26 rigs were drilling in Saskatchewan, further cementing the company’s significance in the Saskatchewan oilpatch. With

24 of 67 active rigs in the province, Crescent Point made up 35.8 per cent of all drilling activity that day.

Their contractors (and number of rigs) included Alliance Drilling and Oilfield Service (3), CanElson Drilling (6) Crusader Drilling (1), CWC Ironhand Drilling (1, in Alberta),

Ensign Drilling (1), Horizon Drilling (2), Precision Drilling (5, of with 1 was in Manitoba), Savanna Drilling (3), Trinidad Drilling (1).

The lone Alberta rig was working in the Swan Hills area. On the Saskatchewan side, another singular rig could be found just four miles north of Kindersley.

Five rigs could be found in the Shaunavon area in a north-south string running 32 miles north and south along the Shaunavon trend.

One rig was working north of Elkhorn, Manitoba in the Manson area. The remainder, and bulk, of the activity, was in southeast Saskatchewan, concentrated in two areas – the Viewfield Bakken area near Stoughton and the Torquay play within sight of the U.S. border, south of Oungre. There, four rigs could be found drilling.

Two outliers could be found, one at Tatagawa and another northeast of Bienfait. In the Viewfield, almost all the nine rigs were working east of Highway 47, with just one exception. Five miles east and three miles north of Stoughton, in the community pasture, the company did one of those things Crescent Point does from time to time – line up several rigs side-by-side and spud them at the same time. In this case the horse race included Alliance Rig 5, Horizon Rig 34, Precision Rig 380 and Crusader Rig 2. It was an impressive sight, with three of the four rigs lined up in a perfect line (the fourth was offset to the north), all within a mile.

The map of southeast Saskatchewan rigs truly told the tale. All but three rigs east of Highway 9 were idled. A cluster of 10 rigs within a 12-mile radius of Carnduff was all

racked. Another five spread out north of Highway 13 between the Manitoba border and Carlyle were also idle.

Other significant areas of activity in the southeast that were not Crescent Point-related was included a string running northwest to southeast from east of Lampman to north of Northgate, with Legacy Oil + Gas and Vermillion Energy doing the drilling, and a cluster of rigs working near Oungre. Those rigs were working for Arc Resources, Enerplus, Torc Oil & Gas were all drilling with one rig each. If it were not for the Crescent Point activity, Southeast Saskatchewan drilling activity would be all but dead.

Things aren’t much different in the southwest, either, with only Federated Co-op and Surge Energy operating one rig each. The letter Pipeline News has spoken to a

number of vendors who work with Crescent Point. All the companies who do significant business with the company got “the letter.” That letter, dated Dec. 16, and signed by CEO Scott Saxberg and COO Neil Smith, starts out by talking about how the company values their suppliers, but

with oil dropping from US$100 WTI to $55 (at that time), margins and cost structures of $100 oil “are no longer sustainable.”

Their “capital budget and capital activities for 2015 are expected to be cut dramatically.”

“Our objective is to maintain a certain activity level keeping crews busy and supplies moving and effectively doing more with lower costs,” the letter stated. “We can only do that with our vendors cutting their cost structure dramatically at this stage in the price cycle. The alternative is no activity and idle crews. When commodity prices recover we will continue to work with those suppliers that valued our relationship during the low cycle and we will work with them to adjust cost structure upwards

when appropriate. We look forward to working with in for the long term.”

The letter concludes with a request for updated prices, and asks for prices and then new pricing with a percentage change. They also ask if there are any other services the vendors can provide and the reduced costs for these services. The letter was in keeping with Saxberg’s comments to investors late in 2014.

All of the vendors Pipeline News spoke to said they intended to comply with the request for reduced pricing.