Stoughton – Before the end of the decade, there could be a new oil refinery near Stoughton, processing Saskatchewan oil and selling the finished product to Saskatchewan vendors.

On Dec. 1, Quantum Energy, Inc. of Tempe, Az., announced it was forming a Canadian subsidiary, Dominion Energy Processing Group, Inc. (DEPGI), whose focus would be building a 40,000 barrel per day oil refinery near Stoughton. The project is expected to cost of $600 million.

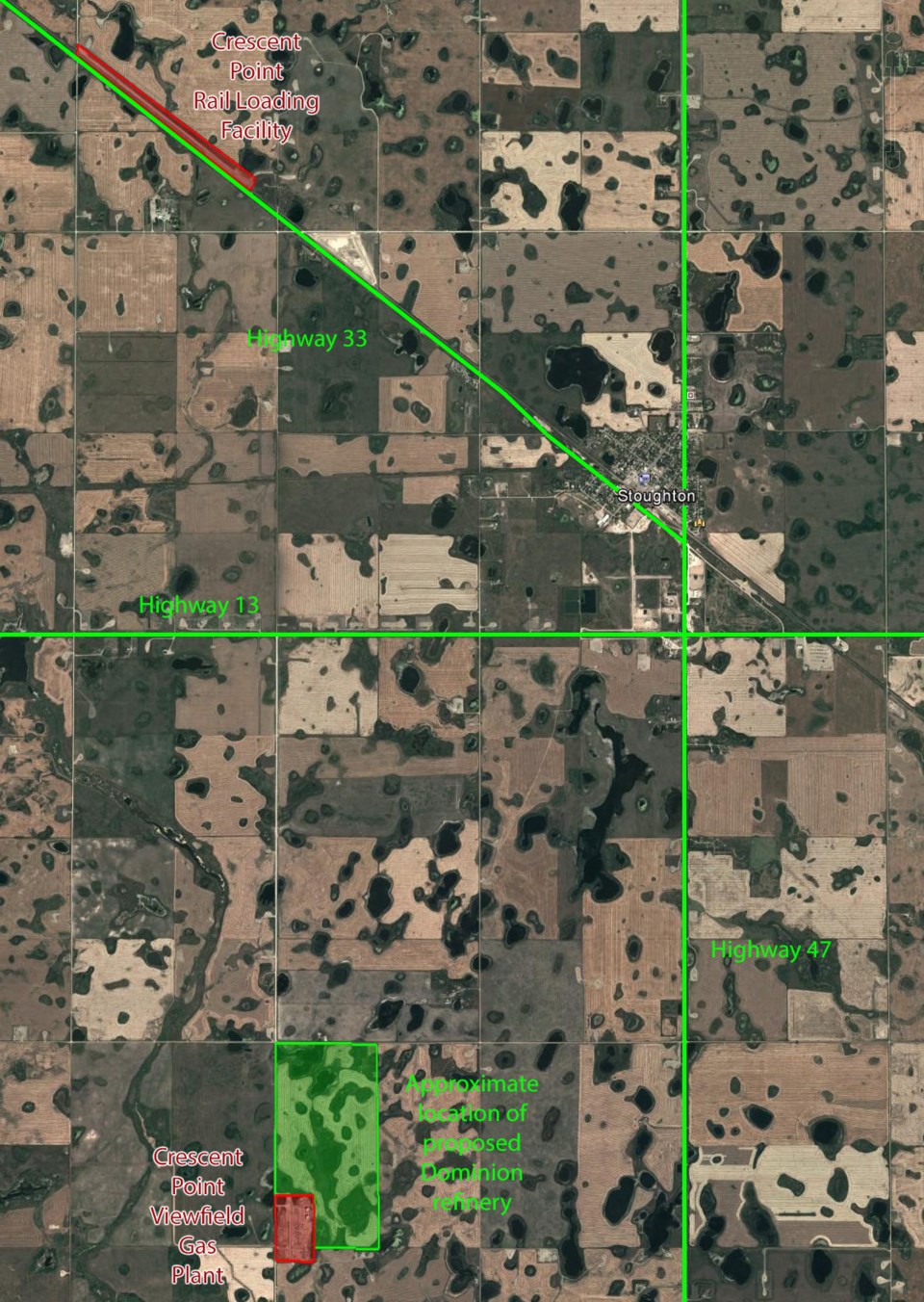

A week later the Quantum announced it had contracted 320 acres of land for the project, located immediately adjacent to the Crescent Point Energy Corp. Viewfield gas plant. That gas plant is 3.2 kilometres west and 4.8 kilometres south of the intersection of Highways 13 and 47, the southern edge of Stoughton. The land location for the proposed refinery site is the western half of 8-8-8-W2, according to Guy Shepherd of Moosomin’s Farm Boy Realty, who handled the transaction.

The Crescent Point Viewfield facility is also connected the Tundra Energy Marketing Ltd.’s (formerly Enbridge’s) Westspur pipeline system, the principal gathering network for southeast Saskatchewan.

Keith Stemler is CEO of Dominion Energy Processing Group, Inc. Pipeline News spoke to him by phone at length on Dec. 14.

Incorporated nationally, Dominion’s corporate headquarters will be in Regina.

As their chosen site is right beside Crescent Point Energy’s main facility in the prolific Viewfield Bakken region, which has its own associated rail loading facility a few kilometres to the north, we asked about their relationship with Crescent Point.

“We’re in negotiations with them on a feedstock, but that’s still not been 100 per cent finalized. But they’re part of our strategic alignment in the location. That’s all I can say at this point,” Stemler said.

The announced capacity, 40,000 bpd, is not far off from Crescent Point’s production in the area. A few years ago, Crescent Point was producing over 50,000 bpd from its Viewfield area. Will this refinery act as a merchant refinery, and accept crude from surrounding producers, or would it be locked up largely, and perhaps exclusively, by Crescent Point?

Stemler said, “Still undecided. We’re still working with about three other vendors, not directly, but indirectly, to make sure we get our volumes.

“We understand what the pipeline connection points are, and where we might have to tap off a line. But we’re still in negotiations with different vendors to make sure we get our 40,000. So the volume is still in the works, as far as our daily volumes.”

Their own gathering system from other suppliers has been discussed. “We haven’t moved forward on any sort of avenue with regards to (a) collection system. But it’s been discussed. In the area, we’ve looked at the network that’s there. There’s been a variety of different discussions on meeting the volume of 40,000,” Stemler said.

When it comes to transporting out refined product, he said, “We’re a little premature. We’ve been discussing some off-take situations with different off-take vendors that we want to work with. There’s been some question with regards to railing it, or trucking it into the Regina or Estevan area. The product would be staying in Saskatchewan. As far as the movement goes, right now we’re still discussing trucking.

“As far as upgrading the infrastructures around the plant, it has been discussed with the municipality, as well as the Ministry of the Economy. We have discussed all those points on traffic. One of the key things about the traffic is just how the infrastructure is designed, how it’s built, what do we need to do to rehabilitate it to get it to a level of comfort, just to get our equipment it. It is definitely a huge discussion point at this time.”

“We’re still in the detailed design stage,” he said.

Construction

As for cost, he said, “Right now our budget is set at $600 million. That includes our water feeds, from start to finish, all our construction, infrastructure upgrades; that’s our whole budget right now.”

“Right now, from start to finish, the first oil we would still like to get a finished product in 2019. It would be 2.5 to three years to complete.”

When they begin scratching dirt boils down to the permitting process, he said. “If we can turn the permit around, as discussed, we could possibly start turning dirt in July/August 2017. That’s our target.”

“The total footprint is 320 acres. The biggest part of our footprint is going to be our water collection system. Water is a key component to a hydrocarbon plant, right? We’ve got a variety of ponds. So we’ve got a good portion of land for water, recirculation and recovery system.

“The initial plan for Train 1 will be offset of the centreline of the property, allowing us for future expansion as well. With this footprint, that plant, with tank storage, will sit on 180 to 210 acres. So it’s a big plant.”

During construction, on the civil side going into the mechanical phase, he expects about 200 people at work. “On the operating staff, it will be 60 people to run it, for the one plant,” he said.

The slack labour and housing market is definitely one of the drives behind the project. “We’re trying to catch this little downturn in the market, not only for better steel prices, but the mod yards are a little bit slower now. We would use mod yards in Saskatchewan. We’ve got a couple chosen vendors.”

On local housing, he said he’s met with the mayor of Stoughton with regards to building new houses or a subdivision, if required. There is housing available, and lots of hotel space available, he noted for the build phase.

Expressing a preference for local contractors, he said, “We want to try to get as many local people as possible so we don’t get into that situation, as far as camps and hotels. We’re not at that level at this point in time. I have checked out the local area, as far as camps, hotels, even restaurants and how the guys will get food.”

As for tank storage, there is still detailed design work to be done, looking at things like how much surge storage will they need, and can some be stored below ground?

“On the finished product side, we’re probably going to run into … 480,000 barrels of finished storage is what we’re planning right now. That would include our slop tank and EDP.”

Refined product

They are not seeking to export finished product to the U.S., but rather to sell it in Canada, for consumption in Canada. The facility would produce 21,540 bpd of retail gasoline and 13,600 bpd Jet and/or ULS diesel. It would also produce natural gas liquids, drilling mud oil, ULS fuel oil, sulphur and carbon dioxide.

“Our intention is to get to the rail distribution. If we can get to the transload, and we haven’t even discussed that with any of the rail people at this point of time. We’re still negotiating different things for offtakes. Part of that offtake is depending on what the vendor wants to do as well. If they want it railed, we’ll work on those terms with the rail people. But at this time, we’re just getting into the technical part of the offtakes. It’s up to the vendor. The vendor will dictate how he wants to see the product flow in the long term.”

He used an example of a small gas station company buying gasoline from Fort Saskatchewan, Alta. They would pay freight on board (FOB) at the rack. “You pull your truck in, you fill it up truck and away you go,” he said. “That’s typically how you go. Now, on a long-term situation, the purchaser of the product might want to rail it, because he’s shipping it somewhere else or it’s going to be a drop-ship type component on his end. Done. It still hasn’t been determined. But we still would like to see all the product stay in Saskatchewan. That’s the whole intent of this.”

Is there enough demand?

“Oh yes, definitely,” he replied.

Hydrocracking refinery

Stemler said it would be a hydrocracking refinery. That’s a more complex refinery than, say, a topping refinery. “It’s all wet,” he said. “This is all hydrocracked, atmospheric cracked. No coker. We don’t need to put in a coker. With this sweet crude, we don’t have to.”

Salt and H2S will be stripped out, he noted.

Other projects

Dominion’s parent company, Quantum Energy Inc., has made similar announcements and land deals at Baker, MT, Fairview, MT, Stanley, ND and now Berthold, ND in 2014, before the crash in oil prices that has resulted in a two year downturn. Asked what has happened with those projects, Stemler said,

“The Berthold one has been in permitting now for several months. It’s continually working with the State of North Dakota. That’s part of the dilemma. We do have the land. So it’s just a matter of excercising some certain options with permitting.

“I don’t know all the details. I don’t deal with that plant. There’s another group in the States that’s diligently working towards … There was some changes in management in Quantum in the last year. So they’re still working on it.”

Asked what they’re doing differently in Canada to ensure the success of the Stoughton project, he said, “The Canadian group, we’ve been working with the government for about 18 months.”

“The capabilities, I think, are a little different in Canada.

“I think there’s more coordination, can we say, between the company, the government and the local administration, the RMs and stuff that are welcoming this plant which allowed us the confidence to move forward at a more rapid pace.”

Pipeline News spoke to Ed Dancsok, Assistant Deputy Minister, Senior Strategic Lead for Petroleum and Natural Gas Development, Ministry of the Economy, who confirmed the refinery proponents have been speaking to the government for about 18 months.

Stemler said, “To start one of these projects is a huge task, because there’s an alignment on stakeholders that it takes a long time to develop what you’re going to do, just in a planning stage. Now that we’ve completed that planning stage and the first part of our stakeholder alignment, it allowed us to move forward and start to announce the project. Are we a long way away? We’re still through a lot of negotiations. It’s not that easy just to throw out an announcement. There’s a lot of background that’s been done – carbon emissions, carbon tax problems, is it a federal thing? There’s a lot to this. I think some people are saying this just came out of the blue. It maybe it did on the announcement, but in the background, no, we’ve been working. We’ve had a team on this for quite some time.”

CO2

Quantum’s Dec. 14 press release noted the project would have “CO2 recapture to limit greenhouse emissions and to support long-term tertiary recovery for EOR within the Canadian Bakken/Torquay region.”

It would also have the development of an 85 megawatt steam driven co-generation power plant that will not emit atmospheric CO2.

Asked about carbon capture, which cost $1 billion to add to a coal-fired generating unit at SaskPower’s Boundary Dam Power station, Stemler said, “There’s a difference between an outside the boundary (OSB) recapture system, where you have to actually produce another product to capture the CO2. So in our state, we have a design which is proprietary, we’ve designed this over the last couple of years, where we actually do this in-line. So the equipment is far different from what they have right now. It’s very high tech stuff. It’s proven. It works. I can’t tell the plant. They’ve already set one of these up in the United States and it works fantastically. Hopefully, this group, we’ve employed them to come on board with our engineering group to work through all the details with us as well.”

They’ve already got a carbon dioxide buyer lined up. Stemler said, “Right now, the CO2 that we recapture is already claimed by a vendor. It is a purchased product. That offtake has already been committed to. So part of the plan was, if we recapture, do we have a buyer? Yes, we do.”

The captured carbon dioxide would be used for CO2 enhanced oil recovery (EOR). This process has been used in the nearby Apache Midale Unit on at test basis since 1984 and on commercial scale for over a decade. It is also used, to a greater extent, in the Cenovus-operated Weyburn Unit.

Small refineries in Williston Basin

The Stoughton announcement is part of a movement towards small refineries in the Williston Basin. In recent years, WBI Energy Inc., (a subsidiary of MDU Resource Group Inc.) built the 20,000 bpd Dakota Prairie Refining LLC project near Dickinson, N.D. In June 2016 Tesoro Refining & Marketing Co. LLC bought that plant, making it Tesoro’s second refinery in the state.

Meridian Energy Group, Inc. is in the permitting process to begin construction in 2017 of the Davis Refinery, at Belfield, N.D., just a few kilometres west of the Dickinson refinery. These are in addition to Quantum’s previously announced plans for multiple refineries throughout North Dakota and Montana.

Stemler explained how new, small greenfield refineries now make sense, when hardly any new refineries have been built in North America over the last three decades. He said, “If you’re specific on what your feedstock is, you can design the kit, the actual processing system, to meet that oil, without upgrading. If you take off a blended product line, like the Tundra line, you require an upgrader. As soon as you start to get into upgraders, your facility requirements start to change. Then you’re into the billions of dollars on the spend.

“For merchant refineries, they have to be designed and operated much more technically, with a lot more logic in them to provide a finished product off a modulated crude slate.

“These plants, although they’re small, technically they’re so advanced, they can handle a change in product, but not a drastic change. So in the Bakken, if you look at how MDU did their plant – and this is probably part of our delay, because we dissected that plant – what they did wrong, what they did right, what made them different from others. Through the lessons learned, we were able to increase our design immensely while still staying on a good budget.

“If you take a big plant, to redo Co-op, would probably be maybe $6 billion. But for $600 million, you can do smaller merchant refineries. And if you do three of them, your output quantities are going to be relatively the same. But you design the plant for the local feedstock, whether it’s Bakken, or, maybe if you go into southwest Saskatchewan where your feed is going to be a little different, you design the plant for that specific product. That’s the difference.

“You want to stay away from upgrading. Upgrading is where it really gets into environmental concern, cost concern, waste concern. There are so many different issues with an upgrader.”

As for possible expansion down the road for Stoughton, Stemler said, “It depends on the offtake commitment. We’re talking to different groups in regards to how we configure that side of the plant. We’re still waiting on feedback from a European company as well as a Canadian company about putting in a specialty plant that can feed off the main system. So we’re looking at a couple of different things.”

Asked why the websites for both Quantum and Dominion do not include phone numbers or street addresses, he explained, “As we grow, more information will be put on those websites. We didn’t want to publish private phone numbers until we get to that corporate level where we’re headed to in the New Year. So once we get that corporate level, that corporate identity set up, yeah, those websites will grow.”

Town hall meetings

There will be two upcoming town hall meeting in Stoughton in early 2017. At a later date, they will have a contractors meeting as well. Stemler doesn’t want to be overrun with potential contractors at the public meetings, should any sort of problem arise that could delay the start date.

“It’s essential people know it continues to move forward in a positive manner. That’s what we’re trying to ensure to, not only the stakeholders, but also the investors in the company. I’ve been at this for two years, and it’s kind of my project. I see good things for the local community. I see good things for the province, as we push forward. That’s really what we’d like to achieve at the end of the day. That’s what we’re working towards,” Stemler concluded.

The Refinery That Wasn’t series of stories, published May 30, 2018

Was there ever going to be a Stoughton refinery?

One says ground will be broken this year, the other doesn’t

Crescent Point has no insight on refinery project

Quantum Energy announced five refineries before Stoughton, none are built

Ministry of Environment has not heard from Quantum/Dominion for over a year

North Dakota refinery market getting crowded

How many workers does it take to build a refinery?

You could rent refinery proponent’s head office by the hour. We did.

New head Quantum office has a lot of tenants

We’ll call you resulted in no calls we could find