Calgary– Millennium Stimulation Services Ltd. has launched their new liquefied natural gas-based frac system, and will be deploying it to the field likely before this edition hits the stands.

“Cyclone Z” is the name of their system of an all-hydrocarbon frac, fracking with frack oil and using ENG, their trademarked term for energized natural gas, according to Mike Heier, president and CEO of Millennium.

Water or oil can be energized with natural gas. “It becomes really, really high pressure natural gas.”

(A detailed story on the actual processed can be found on Page A20)

Using this system minimizes water or frac oil usage, as well as frac flowbacks and flaring.

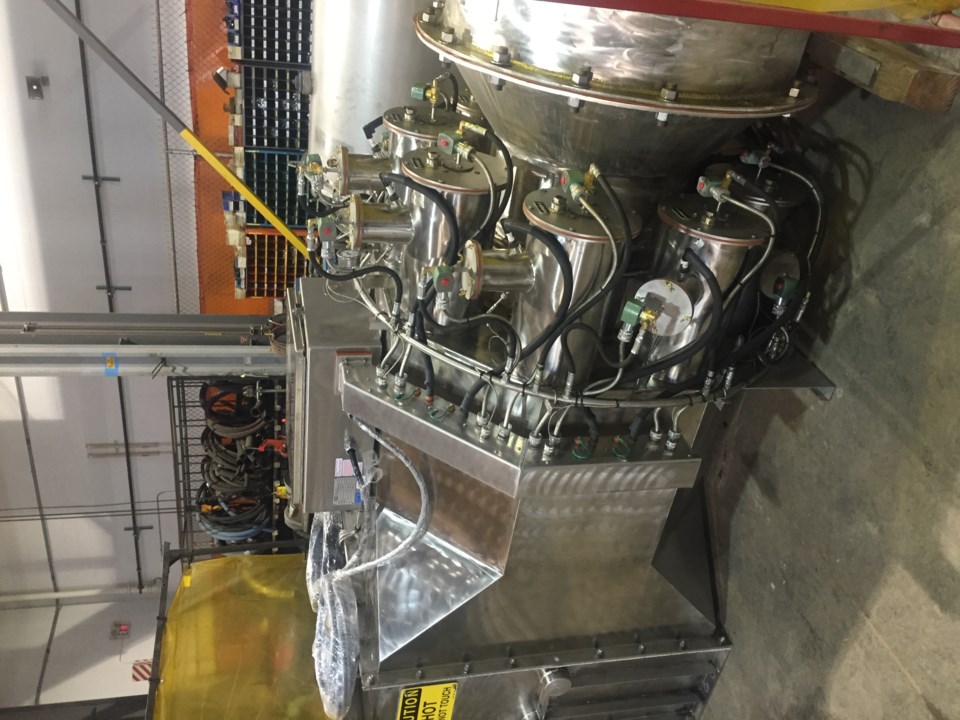

“Our first cryogenic pump, we just finished all the mechanical and electrical work and we will be doing tests on it next week,” he said on Sept. 10. “We’ll be doing an actual high-pressure LNG test in about two weeks time and it will be going out into the field for a number of clients.”

“We don’t have anything scheduled in B.C., yet. We have a number of clients that want to do some work with it in northern Alberta, central Alberta,” he said.

About four clients with programs and specific jobs are lined up. “As soon as we’re ready to go, they’re ready to go,” he said. “They want to be the first to pump the stuff, and we’re happy to do that for them.

There are many more clients interested who don’t want to be first, but are interested nonetheless.

“It’s a lot safer than propane, in fact, dramatically safer than propane,” Heier said. He noted a competitor has been using propane, and the physical properties – heavier or lighter than air, flame front travel, all tend in favour of using natural gas.

Natural gas is also a prime commodity, whereas propane is a derivative, he added. It’s also less expensive.

“We’re going out to basically replace water and we’re dealing with what we would call the wholesale level of pricing of natural gas. We don’t want any players in the middle, so eventually you’ll see Millennium operate LNG plants,” Heier said.

Currently, they have two sources of LNG they are working with, one in North Dakota, another in central Alberta. But the volumes available are meagre. So they intend on building their own facilities to minimize the middlemen, making it affordable for the clients. This is in keeping with Millennium’s tendency towards vertical integration of its operations.

“You’re seeing us move as fast as possible into a midstream model. As soon as we start pumping any LNG volumes, the largest part of the invoice is the product we’re selling, the LNG itself. We’re a midstream company that happens to own some transportation pumping gas.”

“We are trying to do a capital raise right now. We have a term-sheet in house right now that we’re dealing with. We have just under $19 million to build our first cryogenic rolling stock – three Cyclone 700s. They’re 700 standard cubic metre per minute high pressure cryogenic pumps. There’s nothing like it out there.”

These pumps are much like commonplace frac pumps, except that there are two pumps on a unit instead of one, using the same large engine. “We’re basically taking a 50 litre frac engine, a 2,500 horsepower Cummins.”

It will provide 2,000-plus horsepower cryogenic delivery during a frac.

While Millennium has two frac spreads of their own, they will be willing to provide this ENG service on frac jobs where another frac operator is doing the main job.

“We’re happy to do that,” he said. “There’s very little barriers to entry to get into the frac industry these days. Aside from just doing a better job than your competitor, eventually everybody catches up to one another. One big barrier to entry is a patented process. The three key takeaway pieces are we’re giving the client a better well. He’s getting more production for the dollars spent, or he’s getting the same production for less dollars, or some combination thereof; an improvement in economics. We get into significantly minimize or replace water use in a frac. And we can minimize or totally eliminate post-completion frac flaring. Those are the three key things we can do.

When energizing a frac with nitrogen or CO2, the result can’t be put into a sales line, so it has to be flare off initially, he noted.

It depends on the size of the frac, but they can replace up to 80 per cent of the total fluid in the well.

“The reason guys use water in a frac instead of frac oil in the first place is just cost. Once you’ve gotten rid of that much water, a lot of guys go back to frac oil, so now you’ve got a totally waterless frac,” he said. “It typically does a better job in the reservoir than water does.”

Most frac oils are in the heavy gasoline to kerosene to diesel.

They might be doing some jobs in Saskatchewan and North Dakota. There’s even interest in using this technology in Texas.

Once they get up to scale with their equipment, they will soon “be on the hook for one or two LNG plants,” he noted.

With their three cryopumpers there will be five transports and seven or eight site storage units called “kings.”

A small scale job, it could be 5,000 to 10,000 gallons of LNG. A larger one could require a couple hundred thousand gallons. A single U.S.-style transport can take about 10,000 gallons at a time.

The last time Pipeline News spoke to Heier, Millennium was in the middle of a fund raise.

“It just got hung. We put a little bit do bed, and the market turtled. So we pulled it back from the table and went out to some ‘strategics’ on global basis on our LNG patents. They’re the ones who’ve come to the table and said ‘We like what you’re doing, but we want the rights in other countries to go chase this.’”

He was reluctant to use names just yet, but they were very large foreign companies, he noted. “They developed an immediate interest in what we’re doing.”

It’s tight, financially, right now, but they will have the equipment and doing a small equity raise.

High oil-to-gas ratio oils, including the Bakken are among the candidates for this type of frac. Heier added that re-fracs are another possibility as one of the larger applications.

“We’re getting applications thrown at us,” he said.