Calgary – It’s not often in Saskatchewan that mineral rights on roughly 500 sections change hands, but the October Crown land sale shows that was roughly the scale of the exploratory licenses that were picked up – about 13.8 townships worth.

A few weeks later, on Oct. 26, Crescent Point Energy Corp., in announcing its 2017 third quarter results, announced they had acquired a substantial amount of land – roughly 600 sections.

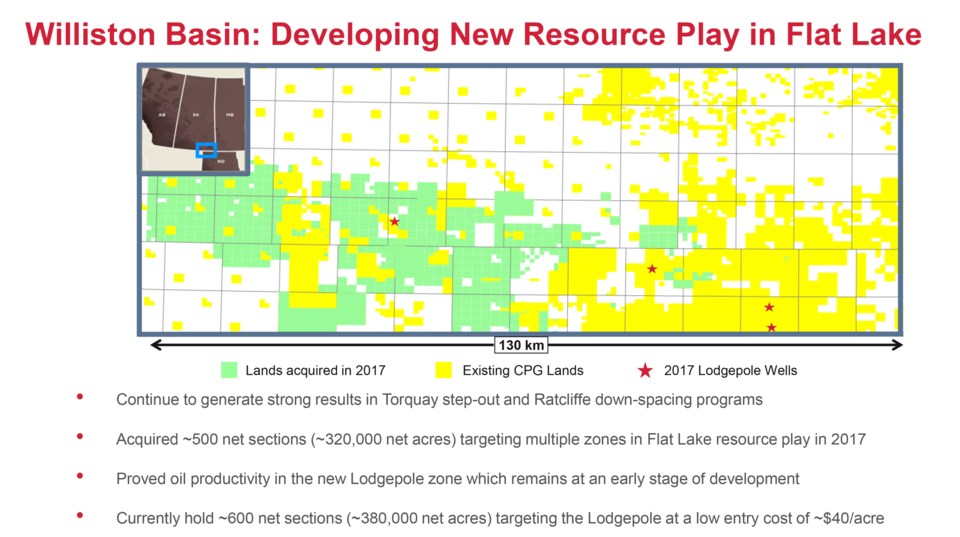

Crescent Point president and CEO Scott Saxberg said, “In the Williston Basin, we continue to expand our multi-zone Flat Lake resource play through our step-out drilling program. Step-out drilling delivered strong results in our Torquay and Ratcliffe zones, and also helped identify new, large oil-in-place resource targeting the Lodgepole. During 2017, we drilled several Lodgepole wells which have proven oil productivity. We are currently working towards improving the overall economics of this play, which remain at the early stage of development.

“We believe the Lodgepole zone provides significant resource potential within our existing core area. With the recent land sales, and prior positions, held by the company, Crescent Point now owns a significant position of approximately 380,000 net acres, or 600 net sections, targeting the Lodgepole zone, at an average working interest of about 100 per cent.

Saxberg went on, “Our cost of entry into this large resource play was less than $40 per acre. In addition to increasing our production guidance, we have also increased our 2017 capital expenditure budget by $100 million, to $1.55 billion. We have primarily allocated this capital to the new play development, and expansion in the Uinta and Williston Basins,” he said, adding the additional capital is being funded by non-core dispositions of $190 million, totalling approximately 3,000 barrels of oil equivalent per day. The company is also looking at selling another $100 to $200 million of assets this year.

Saxberg said there was great success in developing the Lodgepole.

“We’ve been working on this play for a couple of years now. We saw, as we drilled through to the Torquay and Ratcliffe zones, that we were hitting this oil-charged zone in the Lodgepole, and we were getting oil over the shaker as we drilled through the rock,” he said.

“A couple of years ago we started the process of collecting core data, mapping out that zone, testing the rock properties, comparing it to the other zones and the productivity. We were able to map out this resource effectively from the border all the way to the north part of the extension of the land sales we just acquired. This resource is well over 600 square miles in size, and stretches from the border to the extension of our land sales.

“Our strategy this year was to drill four to five exploration wells all along the trend to prove up oil productivity all along the trend. So we did that, effectively from early this year. Our first well was just at the end of Q1 into Q2. We saw the productivity there and then followed it up with three more wells along that trend and got oil productivity across those three wells. We obviously posted those lands back in April of this year, with that strategy.

“Part of the reason, the rationale for posting such a large block was there’s TLE claims which are native Indigenous claims out there, under a Saskatchewan program. We wanted to prevent those claims from happening, and so we posted all those lands in a large block, as well, strategically, to capture that land without any competition.

So early in the middle of the year we had a small land sale that we purposely set up to target that land sale, then followed up with a second land sale. It was able, for us, to capture that land at $40 an acre, which, when you look at the full cycle of this large resource, if it works out the way we think, it will be a large, full cycle economics. It’s still early days. The completion techniques we used, we don’t think were perfect and proper. So we’re going to follow up in the new year with some testing of new completions to optimize it. Basically we’re trying to target similar reserves, productivity, as the Torquay,” Saxberg said.

Asked by an investor during the conference call if the Lodgepole was a large resource opportunity, or smaller, discrete opportunities, Saxberg said it was full, mappable from the border to the northwest corner of the land sales. “It’s a large resource we would anticipate would have similar economics to our Torquay play. Definitely a consistent trend,” he said.

While the company announced an increase in its capital budget, by Nov. 20, it had drawn down its Canadian drilling program to just two drilling rigs, one near Stoughton and one near Dodsland, according to Rig Locator.